A Comprehensive Guide to Real Estate Closings in Orlando, FL

Buying a home is a significant milestone, and understanding the closing procedures in Orlando, FL, is crucial for a smooth and successful transaction. Whether you’re a first-time homebuyer or a seasoned investor, this comprehensive guide will walk you through each step of the real estate closing process in Central Florida, ensuring you’re well-prepared and confident as you approach the finish line. This article will help you understand what to expect when buying a home in Orlando, FL, and the nuances of closing on a home in Central FL.

What is a Real Estate Closing?

A real estate closing, also known as settlement, is the final step in the home buying or selling process. It’s the point where ownership of the property is officially transferred from the seller to the buyer. This involves signing all necessary legal documents, transferring funds, and recording the deed with the county. Understanding the closing process is paramount, especially when buying a home in Orlando, FL, to avoid unexpected hurdles.

Why is Understanding the Closing Process Important?

Understanding the closing process empowers you to:

- Anticipate Costs: Knowing the various fees and expenses involved helps you budget accurately and avoid surprises.

- Meet Deadlines: Familiarizing yourself with the timeline ensures you complete all required tasks promptly.

- Avoid Delays: Understanding potential roadblocks allows you to proactively address them, preventing closing delays.

- Make Informed Decisions: Comprehending the legal documents and their implications allows you to make confident choices.

- Ensure a Smooth Transaction: A clear understanding of the process contributes to a less stressful and more efficient closing.

Key Players Involved in the Closing Process

Several key players work together to facilitate a successful real estate closing. Here’s a rundown of the individuals and entities you’ll likely encounter:

- Buyer: The individual or entity purchasing the property.

- Seller: The individual or entity selling the property.

- Real Estate Agents: Represent the buyer and seller, guiding them through the process.

- Closing Agent/Title Company: A neutral third party that oversees the closing process, ensuring all legal and financial requirements are met. They handle the title search, escrow account, and disbursement of funds.

- Lender: Provides the financing for the buyer to purchase the property.

- Appraiser: Determines the fair market value of the property.

- Home Inspector: Evaluates the condition of the property, identifying potential issues.

- Insurance Company: Provides homeowners insurance coverage.

- Attorney (Optional): Provides legal advice and representation to either the buyer or seller.

Understanding the roles of these key players is critical to navigating the complexities of closing on a home in Central FL.

Step-by-Step Guide to the Real Estate Closing Process in Orlando, FL

The closing process involves several crucial steps. Understanding each step will help you navigate the process smoothly.

1. Purchase Agreement and Escrow

The process begins with the signing of a Purchase Agreement (also known as a Sales Contract) between the buyer and seller. This legally binding document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies.

-

Earnest Money Deposit: As part of the Purchase Agreement, the buyer typically provides an earnest money deposit, which is held in an escrow account by the title company or a real estate broker. This deposit demonstrates the buyer’s commitment to the transaction.

- Escrow Account: The escrow account protects the funds until all conditions of the Purchase Agreement are met.

-

Contingencies: Common contingencies include financing, appraisal, and inspection. These contingencies allow the buyer to back out of the deal without penalty if certain conditions are not met.

- Financing Contingency: Protects the buyer if they cannot secure a mortgage.

- Appraisal Contingency: Protects the buyer if the property appraises for less than the purchase price.

- Inspection Contingency: Allows the buyer to have the property inspected and request repairs or back out of the deal if significant issues are found.

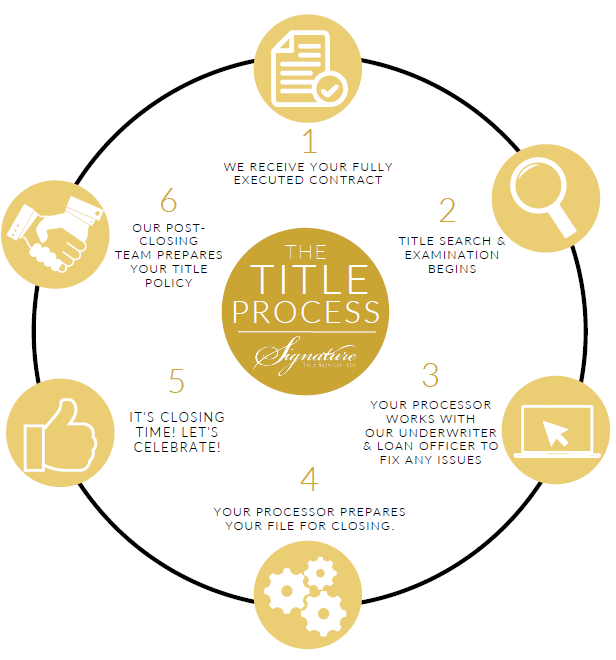

2. Title Search and Title Insurance

The title company conducts a thorough title search to ensure the seller has clear ownership of the property and that there are no outstanding liens, encumbrances, or other claims against it.

- Title Search: This involves examining public records to identify any potential issues with the title.

- Title Insurance: Title insurance protects the buyer and lender against any losses that may arise from title defects that were not discovered during the title search. There are two types of title insurance:

- Owner’s Title Insurance: Protects the buyer’s investment in the property.

- Lender’s Title Insurance: Protects the lender’s interest in the property.

Securing title insurance is a fundamental aspect of closing on a home in Central FL, providing peace of mind against unforeseen title issues.

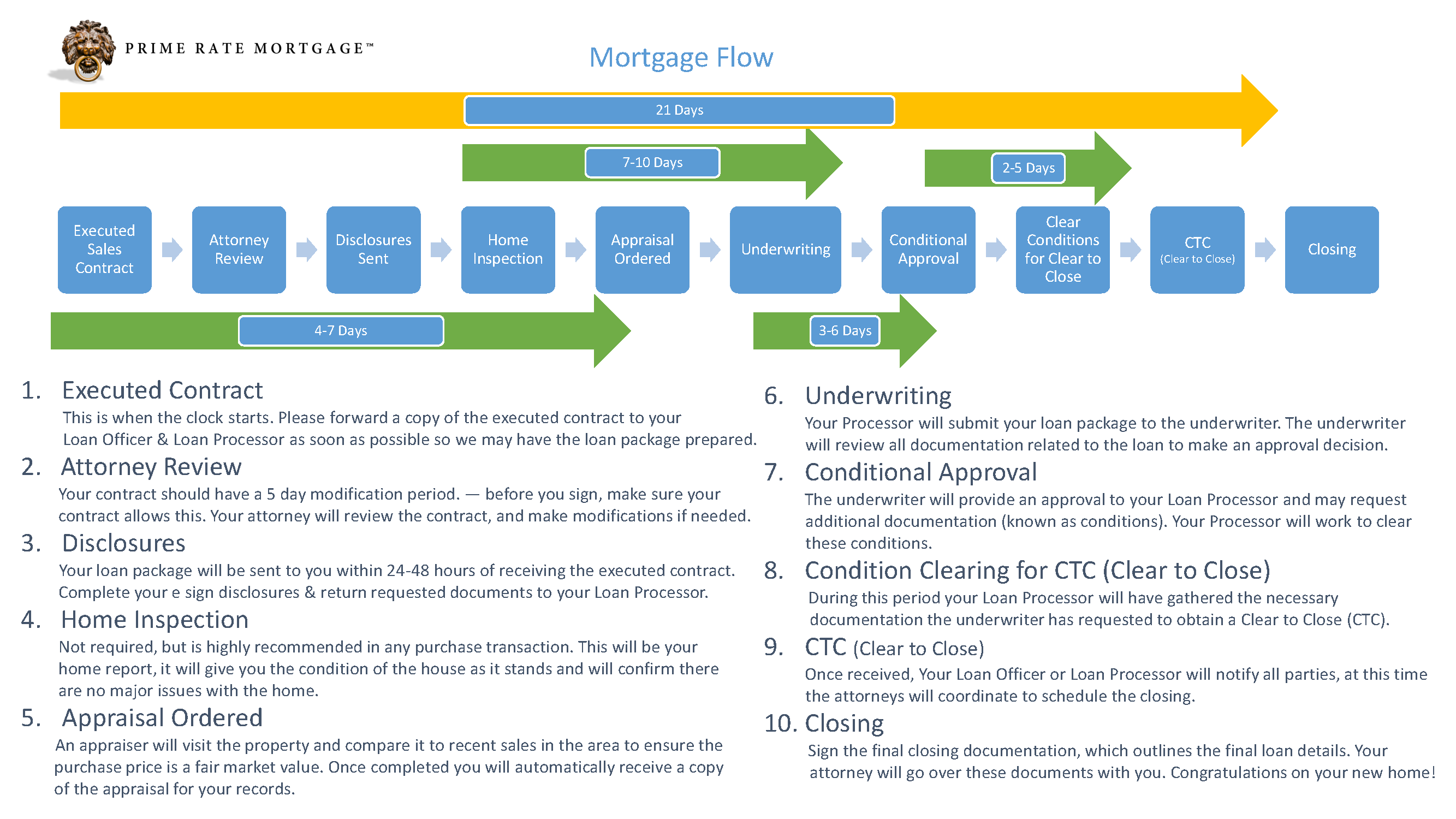

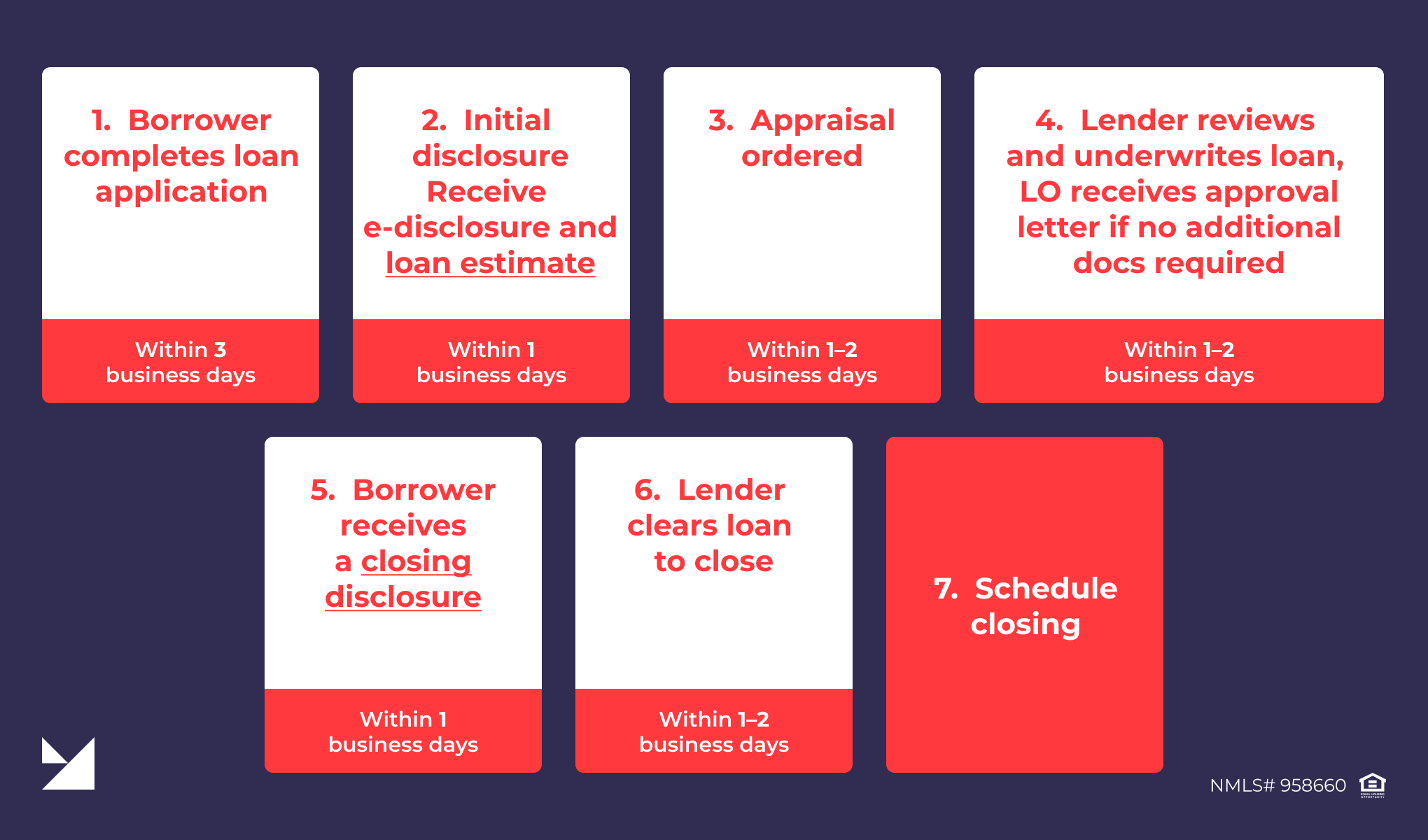

3. Loan Processing and Underwriting

If the buyer is financing the purchase, the lender will process the loan application and conduct underwriting to assess the buyer’s creditworthiness and ability to repay the loan.

- Loan Application: The buyer provides the lender with detailed financial information, including income, assets, and debts.

- Credit Check: The lender reviews the buyer’s credit history to assess their creditworthiness.

- Appraisal: The lender orders an appraisal to determine the fair market value of the property.

- Underwriting: The lender analyzes the buyer’s financial information and the appraisal report to determine whether to approve the loan.

4. Home Inspection and Repairs

The buyer typically hires a licensed home inspector to evaluate the condition of the property.

- Home Inspection Report: The inspector provides a detailed report outlining any defects or issues with the property, such as structural problems, roof damage, or plumbing issues.

- Negotiations: Based on the inspection report, the buyer and seller may negotiate repairs or a reduction in the purchase price to address any identified issues.

Addressing any necessary repairs is an essential step when buying a home in Orlando, FL, ensuring the property is in good condition.

5. Final Walk-Through

Before the closing, the buyer typically conducts a final walk-through of the property to ensure it is in the condition agreed upon in the Purchase Agreement and that any agreed-upon repairs have been completed.

- Verification: The buyer verifies that all appliances are working, that no new damage has occurred, and that the property is vacant.

6. Closing Disclosure and Review

At least three business days before the closing, the buyer receives a Closing Disclosure (CD) from the lender. This document outlines all of the loan terms, closing costs, and other important details of the transaction.

- Review: The buyer should carefully review the CD to ensure that all of the information is accurate and that there are no unexpected charges.

- Questions: If the buyer has any questions or concerns about the CD, they should contact the lender or closing agent immediately.

7. The Closing Meeting

The closing meeting is the final step in the process, where all parties come together to sign the necessary documents and transfer ownership of the property.

- Location: The closing typically takes place at the title company’s office.

- Participants: The buyer, seller, real estate agents, closing agent, and sometimes the lender are present at the closing.

- Document Signing: The buyer and seller sign numerous legal documents, including the deed, mortgage, and closing statements.

- Fund Transfer: The buyer’s funds are transferred to the seller, and the closing agent disburses funds to pay off any existing mortgages, liens, or other obligations.

- Recording: The deed is recorded with the county, officially transferring ownership of the property to the buyer.

8. Post-Closing Activities

After the closing, the title company records the deed and disburses funds to the appropriate parties. The buyer receives the keys to the property and can begin moving in.

- Document Retention: It’s important to retain copies of all closing documents for tax and legal purposes.

- Homeowners Insurance: Ensure your homeowner’s insurance policy is in effect.

Common Closing Costs in Orlando, FL

Closing costs are the expenses associated with the real estate transaction, in addition to the purchase price of the property. These costs can be paid by the buyer, the seller, or split between both parties, depending on the terms of the Purchase Agreement. Understanding these costs is crucial when buying a home in Orlando, FL.

:max_bytes(150000):strip_icc()/buyer-s-closing-costs-1798422-final-3054a11ea59a4f3d9877de662819234b.png)

Buyer’s Closing Costs:

- Loan Origination Fees: Fees charged by the lender for processing the loan.

- Appraisal Fee: Cost of the appraisal to determine the property’s value.

- Credit Report Fee: Cost of the lender obtaining the buyer’s credit report.

- Title Insurance (Lender’s Policy): Protects the lender’s interest in the property.

- Recording Fees: Fees charged by the county to record the deed and mortgage.

- Documentary Stamp Taxes (on the Mortgage): Taxes on the mortgage amount.

- Prepaid Items: Funds collected upfront for property taxes and homeowners insurance.

- Home Inspection Fee: Cost of the home inspection.

Seller’s Closing Costs:

- Real Estate Commissions: Fees paid to the real estate agents representing the buyer and seller.

- Title Insurance (Owner’s Policy): Protects the buyer’s ownership of the property (often negotiated).

- Documentary Stamp Taxes (on the Deed): Taxes on the sale price of the property.

- Recording Fees (to clear title): Fees to record documents that clear any title issues.

- Attorney Fees (if applicable): Costs for legal representation.

- Prorated Property Taxes: Portion of property taxes owed for the period they owned the property.

- HOA Fees: Unpaid Homeowner Association fees.

Negotiating Closing Costs

Closing costs are often negotiable. Buyers and sellers can negotiate who pays for which costs as part of the Purchase Agreement.

- Negotiation Strategies: Buyers can negotiate with the seller to pay for some of their closing costs, especially in a buyer’s market. Sellers can negotiate with their real estate agent to reduce commission fees.

Source: www.coeosolutions.com

Potential Challenges and How to Avoid Them

Even with careful planning, challenges can arise during the closing process. Being aware of potential issues and knowing how to address them can help you avoid delays and ensure a smooth transaction.

- Title Issues: Title defects, such as liens or encumbrances, can delay or even prevent the closing.

- Solution: A thorough title search and title insurance can help identify and resolve title issues.

- Appraisal Issues: If the property appraises for less than the purchase price, the lender may not approve the loan.

- Solution: The buyer can negotiate with the seller to lower the purchase price, or they can obtain a second appraisal.

- Inspection Issues: Significant defects discovered during the home inspection can lead to disputes between the buyer and seller.

- Solution: Clear communication and negotiation are key to resolving inspection issues. The buyer and seller can agree on repairs or a reduction in the purchase price.

- Financing Issues: Delays in loan approval or unexpected changes in interest rates can jeopardize the closing.

- Solution: Get pre-approved for a mortgage before making an offer, and stay in close communication with your lender throughout the process.

- Communication Breakdown: Lack of communication between the parties involved can lead to misunderstandings and delays.

- Solution: Maintain open and frequent communication with your real estate agent, lender, and closing agent.

Tips for a Smooth Closing in Orlando, FL

To ensure a seamless closing experience when closing on a home in Central FL, consider these valuable tips:

- Get Pre-Approved for a Mortgage: This will give you a clear idea of how much you can afford and make your offer more attractive to sellers.

- Choose a Reputable Real Estate Agent: A knowledgeable and experienced real estate agent can guide you through the process and advocate for your best interests.

- Work with a Qualified Title Company: The title company plays a critical role in ensuring a smooth closing.

- Read All Documents Carefully: Before signing any documents, take the time to read them thoroughly and ask questions if you have any concerns.

- Meet All Deadlines: Stay organized and meet all deadlines to avoid delays.

- Stay in Communication: Maintain open and frequent communication with your real estate agent, lender, and closing agent.

- Be Prepared for Unexpected Issues: Even with careful planning, unforeseen issues can arise. Stay flexible and be prepared to address them.

- Understand Your Finances: Have a clear understanding of your financial situation and be prepared to pay all required closing costs.

- Ask Questions: Don’t hesitate to ask questions if you’re unsure about anything. It’s better to be informed than to make assumptions.

- Stay Calm: The closing process can be stressful, but staying calm and focused will help you navigate any challenges that may arise.

The Role of Technology in Modern Real Estate Closings

Technology is transforming the real estate closing process, making it more efficient, transparent, and convenient.

- E-Signatures: Electronic signatures allow parties to sign documents remotely, saving time and streamlining the process.

- Online Portals: Online portals provide a secure platform for sharing documents, tracking progress, and communicating with all parties involved.

- Virtual Tours: Virtual tours allow buyers to view properties remotely, expanding their options and saving time.

- Digital Communication: Email, text messaging, and video conferencing facilitate communication and collaboration between all parties.

Embracing these technological advancements can significantly enhance your experience when buying a home in Orlando, FL.

Conclusion

Understanding the real estate closing procedures in Orlando, FL is crucial for a successful and stress-free transaction. By familiarizing yourself with the key players, steps involved, potential challenges, and tips for a smooth closing, you can confidently navigate the process and achieve your dream of homeownership. Remember to work with experienced professionals, stay organized, and communicate effectively throughout the process. With the right preparation and guidance, you can confidently navigate the closing process and enjoy the rewards of buying a home in Orlando, FL. Whether you are closing on a home in Central FL, or simply exploring your options, knowledge is power, and this guide equips you with the knowledge you need to succeed.Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the real estate closing process in Orlando, FL:

Q: How long does the closing process typically take?

A: The closing process typically takes between 30 and 60 days, but it can vary depending on factors such as the complexity of the transaction and the lender’s processing time.

Q: What is the difference between title insurance and homeowners insurance?

A: Title insurance protects against losses arising from title defects, while homeowners insurance protects against losses from damage to the property.

Q: Can I negotiate closing costs?

A: Yes, closing costs are often negotiable between the buyer and seller.

Q: What happens if the property doesn’t appraise for the purchase price?

A: The buyer can negotiate with the seller to lower the purchase price, obtain a second appraisal, or terminate the Purchase Agreement (if there is an appraisal contingency).

Q: What documents do I need to bring to the closing meeting?

A: You will typically need to bring a valid photo ID, a certified check for the remaining funds due, and any other documents requested by the lender or closing agent.

Q: What is a final walk-through and why is it important?

A: A final walk-through is a buyer’s opportunity to inspect the property before closing to ensure it’s in the agreed-upon condition and that any negotiated repairs have been completed. It helps prevent surprises on closing day.

Q: What is the role of the escrow account in the closing process?

A: The escrow account holds the buyer’s earnest money deposit and other funds related to the transaction, protecting them until all conditions of the Purchase Agreement are met.

Q: Who chooses the title company?

A: In Florida, the Purchase Agreement usually stipulates who selects the title company. It is often negotiable between the buyer and seller.

Q: What are documentary stamp taxes?

A: Documentary stamp taxes are taxes imposed by the state of Florida on the transfer of ownership of real property and on mortgages.

Q: Where can I find more information about real estate closings in Orlando, FL?

A: You can find more information from the Florida Bar, the Florida Department of Business and Professional Regulation, and reputable real estate agents and title companies in Orlando.

GET REAL ESTATE HELP….

[wpzf_form id=”444″]